Cecred By Beyonce Travel Sized Hydrating Shampoo. Image Credit Via Cecred, Instagram

The beauty industry, ever-evolving and fiercely competitive, has seen a seismic shift with the rise of celebrity-backed brands. What once started as simple endorsements has blossomed into a full-blown “brand-emic,” particularly in the haircare sector. As we navigate 2025, the landscape is dominated by empires built not just on star power, but increasingly, on genuine innovation and a deep understanding of diverse consumer needs. But in this glittering war for market share, who’s truly delivering the goods, and what does it take to claim the crown for the best celebrity haircare line?

The Battle for Beautiful Strands: Market Leaders in 2025

While exact, finalized sales statistics for the entirety of 2025 are still unfolding, early indicators and ongoing trends point to a few dominant players in the celebrity haircare space. Brands that launched in late 2023 and early 2024, like Beyoncé’s Cécred and Rihanna’s Fenty Hair, are showing immense momentum, challenging established names like Tracee Ellis Ross’s Pattern Beauty and Priyanka Chopra Jonas’s Anomaly Haircare.

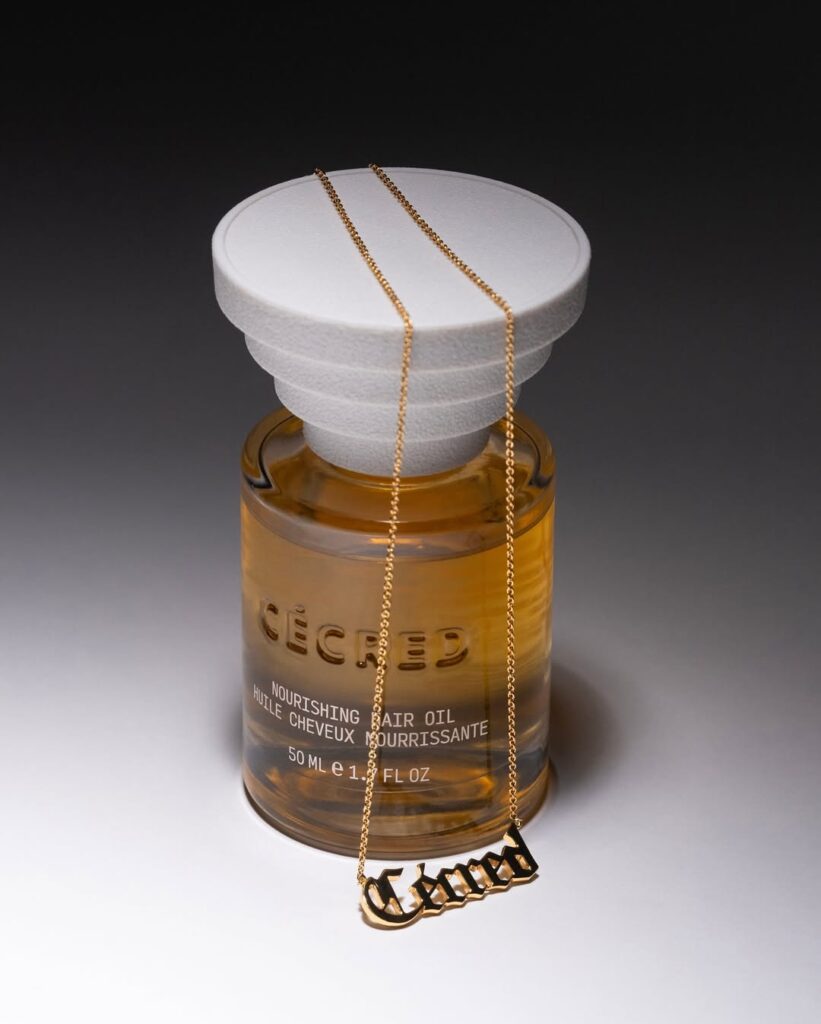

Cécred By Beyonce

Cécred, launched in early 2024 and expanding into over 1,400 Ulta Beauty locations by April 2025, has made a remarkable splash. Reports from early 2025 indicated that the brand doubled its weekly e-commerce sales projections in just one day following its Ulta launch, a testament to Beyoncé’s immense influence and the brand’s early traction. It quickly garnered 2 million paying customers within its first six months post-launch, showcasing a rapid ascent. Ulta Beauty itself called the Cécred launch potentially their “largest launch, period, in our history,” driven by this explosive initial demand.

Fenty Hair By Rihanna

Fenty Hair by Rihanna, which debuted in June 2024, came onto the scene with immense digital impact. In its launch month alone, Fenty Hair generated a whopping $24.6 million in Earned Media Value (EMV), nearly doubling Cécred’s launch month performance, and accumulated 47.4 million total engagements across social media. This set a new standard for social media impact in the haircare industry. By April 2025, fentybeauty.com, which includes Fenty Hair products, reported a revenue of over $10 million from 1.3 million sessions, boasting a high conversion rate of 9.0-9.5%, indicating strong customer engagement.

Pattern Beauty By Tracee Ellis Ross

Pattern Beauty, a pioneer in the inclusive haircare space, particularly for textured hair, continues to maintain a strong presence. While specific 2025 sales figures are harder to pinpoint, its consistent positive reviews and dedicated customer base suggest sustained success. Similarly, Priyanka Chopra Jonas’s Anomaly Haircare, founded in 2019, has made “big waves” in the USA, reportedly generating impressive revenue, though exact current figures for 2025 are still emerging.

The Head-to-Head: Fenty Hair vs. Cécred – The Demand Debate

When directly comparing the demand for Fenty Hair and Cécred, it’s a tight race, with both brands exhibiting remarkable consumer interest and market penetration in early 2025. There are different ways to gauge “most demanded,” and both have excelled in distinct areas:

- Initial Digital & Social Media Impact: Fenty Hair undeniably had a more explosive launch in terms of social media buzz and earned media value. Its EMV and engagement figures in its debut month significantly outpaced Cécred’s, showcasing Rihanna’s unparalleled ability to generate widespread immediate digital attention. This suggests a higher initial curiosity and buzz-driven demand.

- Retail Accessibility & Sales Conversion: Cécred’s strategic and widespread launch across over 1,400 Ulta Beauty stores by April 2025 has translated into immense demand at the point of sale. The reported doubling of weekly e-commerce sales projections in a single day after its Ulta launch indicates a strong conversion of interest into actual purchases through accessible retail channels. This points to a consumer base actively seeking out and buying the product in large volumes as it became widely available.

- Leveraging Ecosystem vs. New Ground: Fenty Hair benefits from the existing, highly successful Fenty Beauty and Fenty Skin empire, which provides a pre-built marketing and distribution platform to drive demand. Cécred, while backed by Beyoncé, was a newer, self-funded venture, and its rapid demand surge, especially through Ulta, demonstrates its ability to carve out significant market share quickly on its own merits, amplified by broad retail access.

In essence: While Fenty Hair’s launch generated more initial buzz and digital engagement, Cécred’s widespread retail launch has seemingly translated into exceptionally high conversion of demand into sales at scale. Both are incredibly successful and highly demanded, showcasing different pathways to market dominance.

The Ingredients Debate: Good, Bad, and Natural

A significant factor differentiating these brands is their ingredient philosophy. Consumers in 2025 are more ingredient-savvy than ever, demanding transparency and efficacy.

Positive Ingredients (The “Good”): Leading celebrity haircare lines often champion a range of beneficial ingredients. We see a heavy emphasis on:

- Natural Oils & Butters: Argan oil, shea butter, coconut oil, jojoba oil, and castor oil are celebrated for their moisturizing, nourishing, and protective properties. Cécred, for instance, heavily features ingredients like shea butter and a proprietary Bioactive Keratin Ferment for repair. Fenty Hair’s own Replenicore-5 complex includes ingredients like Barbados gooseberry and upcycled jackfruit extract for repair, hydration, and protection.

- Proteins: Keratin, silk proteins, and hydrolyzed vegetable proteins are common for strengthening hair, repairing damage, and improving elasticity.

- Vitamins & Antioxidants: Biotin, Vitamin E, Vitamin B5 (Panthenol), and various plant extracts provide nourishment, protect against environmental damage, and support scalp health.

- Hyaluronic Acid: Increasingly used for its exceptional hydrating capabilities, drawing moisture into the hair strand.

- Botanical Extracts: Rosemary, aloe vera, tea tree oil, and various fruit extracts are used for scalp health, stimulating growth, and imparting natural fragrance.

Harmful Ingredients (The “Bad”): The “clean beauty” movement has put a spotlight on ingredients consumers increasingly wish to avoid. Many celebrity brands tout formulations free from:

- Sulfates (SLS/SLES): Harsh cleansing agents that can strip natural oils, leading to dryness and irritation, especially for curly or sensitive scalps.

- Parabens: Preservatives linked to potential hormonal disruption.

- Phthalates: Used in fragrances and plastics, also associated with health concerns.

- Silicones (heavy, non-water-soluble types): While they provide shine and smoothness, some can build up on hair, leading to dullness and preventing moisture penetration.

- Formaldehyde-releasing agents (e.g., DMDM Hydantoin): Preservatives that can release formaldehyde, a known allergen and carcinogen.

- Synthetic Fragrances/Dyes: Often undisclosed blends of chemicals that can cause irritation or allergic reactions. Many of the newer celebrity haircare lines proudly declare themselves “sulfate-free,” “paraben-free,” and often “silicone-free,” aligning with consumer demand for healthier formulations.

The Most Used Celebrity-Based Haircare Lines

While hard “most used” statistics across the entire market are scarce, brand visibility and early sales data in 2025 indicate a fierce competition for usage. Cécred is rapidly becoming a household name due to Beyoncé’s global reach and its strategic Ulta partnership, driving significant trial and repeat purchases. Fenty Hair leverages the immense Fenty Beauty ecosystem, benefiting from Rihanna’s established empire and capturing users seeking both repair and styling solutions. Pattern Beauty remains a consistent favorite for the textured hair community, a niche it has authentically served since its inception, fostering deep loyalty among its users. Anomaly, with its accessible price point and broad availability, also holds a significant market share in the drugstore space.

The Celebrity Production Industry: A War for Authenticity and Longevity

The celebrity beauty industry is more than just a trend; it’s a full-blown war for consumer trust and loyalty. The market is saturated, with every other celebrity launching a brand, from skincare to makeup to fragrance, and now, haircare.

The “War” is fought on several fronts:

- Authenticity: Consumers are discerning. Brands founded on a genuine passion and personal need (like Tracee Ellis Ross’s journey with her curls, or Beyoncé’s family legacy in hair care) tend to resonate more deeply than those perceived as mere cash grabs.

- Inclusivity: Fenty Beauty pioneered radical inclusivity in makeup, and this expectation has carried over to haircare. Brands that offer diverse product lines catering to all hair types and textures (from straight to coily) gain a significant edge. Fenty Hair’s inclusive packaging, with textured tops for the sight-impaired, is a notable example.

- Innovation & Efficacy: Beyond the celebrity name, products must work. The market demands effective formulations that deliver visible results. Brands are investing heavily in R&D to create unique active ingredients or delivery systems. Cécred, for example, highlights its “patent-pending Bioactive Keratin Ferment,” while Fenty Hair emphasizes its “clinically tested repair technology,” Replenicore-5 complex.

- Sustainability & Ethics: Eco-conscious packaging, cruelty-free testing, and ethically sourced ingredients are no longer optional but expected.

- Price Point: Striking the right balance between luxury appeal and accessibility is key. Some brands opt for premium pricing, while others, like Anomaly, focus on mass-market affordability.

Achievements and Limitations in Products and Natural Ingredients

Achievements:

- Targeted Solutions: Celebrity brands have excelled at creating highly targeted solutions for specific hair concerns (e.g., curl definition, bond repair, scalp health, color protection) often using cutting-edge or rarely seen natural ingredients. Cécred is postured for hair damage, weak, depleted, and chemically processed strands, while Fenty Hair offers a comprehensive approach to repair while also excelling in styling products.

- Democratization of “Clean” Beauty: By bringing “free-from” formulations and natural ingredients to a wider audience, these brands have pushed the mainstream industry towards cleaner standards.

- Innovation in Delivery: New textures, forms (like hair steamers from Pattern Beauty), and application methods have emerged, making haircare routines more enjoyable and effective. Cécred’s “Ritual Shaking Vessel” for its Fermented Rice & Rose Protein Ritual promotes a unique user experience.

- Community Building: Social media allows these brands to build direct, engaged communities, fostering loyalty and feedback loops.

Limitations:

- Ingredient Purity Claims: While many claim “natural,” the term isn’t strictly regulated, and some products may still contain synthetic components or highly processed natural derivatives. Consumers need to scrutinize ingredient lists.

- Scalability Challenges: Maintaining consistent quality and ingredient sourcing at a large scale can be challenging for rapidly expanding brands.

- Marketing Over Substance: Some brands might overemphasize celebrity connection and aesthetically pleasing packaging more than genuine product innovation.

- High Expectations: The immense hype around celebrity launches can lead to unrealistic consumer expectations, sometimes resulting in disappointment if products don’t deliver miraculous results.

Reviews, Sales, Social Media, and Complaints

Reviews from Popular Blogs and Consumers: Reviews for leading brands in early 2025 are generally positive, especially for products that address specific needs.

- Cécred: Widely praised for its luxurious feel, effective hydration, and the unique scent experience (a rich, deep oud aroma). The Moisturizing Deep Conditioner and Restoring Hair & Edge Drops are frequently highlighted for their transformative results. Some reviews mention the initial price point as a consideration, but efficacy often wins out.

- Fenty Hair: Users love products like The Homecurl Curl Defining Cream for defining curls without crunch, and The Rich One Moisture Repair Shampoo for its rich lather and non-stripping cleanse. Its warm, ambery floral scent (yuzu, amber, vanilla) is also frequently noted. Some initial feedback mentioned the lack of written directions on packaging for certain products.

- Pattern Beauty: Consistently receives high marks for its deep conditioners, styling creams, and hair tools, especially from the curly and coily hair communities who value its focus on moisture and curl definition.

- Anomaly Haircare: Appreciated for its minimalist packaging and affordable price point, with mixed reviews on performance. Some users praise its gentleness and scent, while others find certain products too runny or not effective enough for their hair type.

Sales Statistics (Illustrative of 2025 Trends): While exact final 2025 figures aren’t public, the trajectory is clear:

- Cécred: Strong launch performance, quickly reaching millions of customers and doubling initial sales projections, especially after its Ulta expansion in April 2025. This suggests a significant market share gain.

- Fenty Hair: Part of the larger Fenty Beauty empire, which boasts a 2024 valuation of $2.8 billionand revenues exceeding $600 million. Fenty Hair contributes to this impressive figure, with reported monthly e-commerce revenue of $10.1 million from fentybeauty.com in April 2025.

- Anomaly Haircare: Reported a 2024 valuation of $150 million and revenue of $50 million, making it a substantial player in the celebrity haircare segment, particularly in the US mass market.

- Pattern Beauty: While specific financial figures are less widely publicized, its consistent presence and positive reception indicate healthy sales and market presence, particularly within its target demographic.

Social Media Presence and Complaints: Celebrity haircare brands leverage social media heavily for marketing, but it’s also where consumer feedback and complaints often surface.

- Engagement: All leading brands have massive social media followings, driving engagement through tutorials, user-generated content, and direct interaction with their celebrity founders. Fenty Hair’s launch generated 47.4 million total engagements, significantly outperforming competitors.

- Complaints: Common complaints across the board include:

- Availability: Products selling out quickly, especially for popular new launches like Cécred upon its Ulta expansion.

- Price Point: Perceived as too high for some, especially for luxury-positioned brands like Cécred.

- Individual Results Vary: Haircare is highly personal, and what works for one person might not work for another, leading to mixed reviews despite general positive sentiment.

- Packaging Issues: While often aesthetically pleasing (e.g., Cécred’s sculptural bottles, Fenty Hair’s pastel tones), sometimes packaging can be criticized for being impractical or not fully protecting the product.

- Formulation Concerns: Some users may still react negatively to certain “clean” ingredients or find the texture/scent not to their liking.

In conclusion, the celebrity haircare industry in 2025 is a vibrant, competitive, and increasingly sophisticated market. Brands like Cécred and Fenty Hair are leading the charge with strong sales and extensive social media presence, while established players like Pattern Beauty continue to cater to loyal customer bases. The “war” is less about who is the biggest star, and more about who can consistently deliver effective, ethically produced, and truly inclusive products that resonate with diverse hair needs. The future of celebrity haircare will undoubtedly be shaped by genuine innovation and a relentless pursuit of product excellence, beyond just the famous face.